Tax Relief For 2024 Social Security – Although Social Security benefits are taxable at the federal level, most recipients haven’t had to worry about paying state income taxes on their benefits. That will be the case in 2024 as well, . The aim of tax-exempt status is to support organisations that engage in activities that benefit the public or fulfill certain social or charitable purposes. .

Tax Relief For 2024 Social Security

Source : www.pgpf.org

Social Security Benefits Will Rise 3.2% In 2024, While Top Tax

Source : www.forbes.com

Should We Eliminate the Social Security Tax Cap? Here Are the Pros

Source : www.pgpf.org

Social Security COLA 2024: Have You Received Your First Increased

Source : www.cnet.com

Should We Eliminate the Social Security Tax Cap? Here Are the Pros

Source : www.pgpf.org

41 States That Won’t Tax Social Security Benefits in 2024

Source : finance.yahoo.com

Which States Still Tax Social Security Benefits in 2024? | Money

Source : money.com

Social Security COLA 2024 may impact your taxes in a big way

Source : www.foxbusiness.com

Social Security In 2024: 5 Big Changes Retirees Should Plan For

Source : www.bankrate.com

Social Security benefits will rise 3.2% in 2024, while top tax

Source : www.voya.com

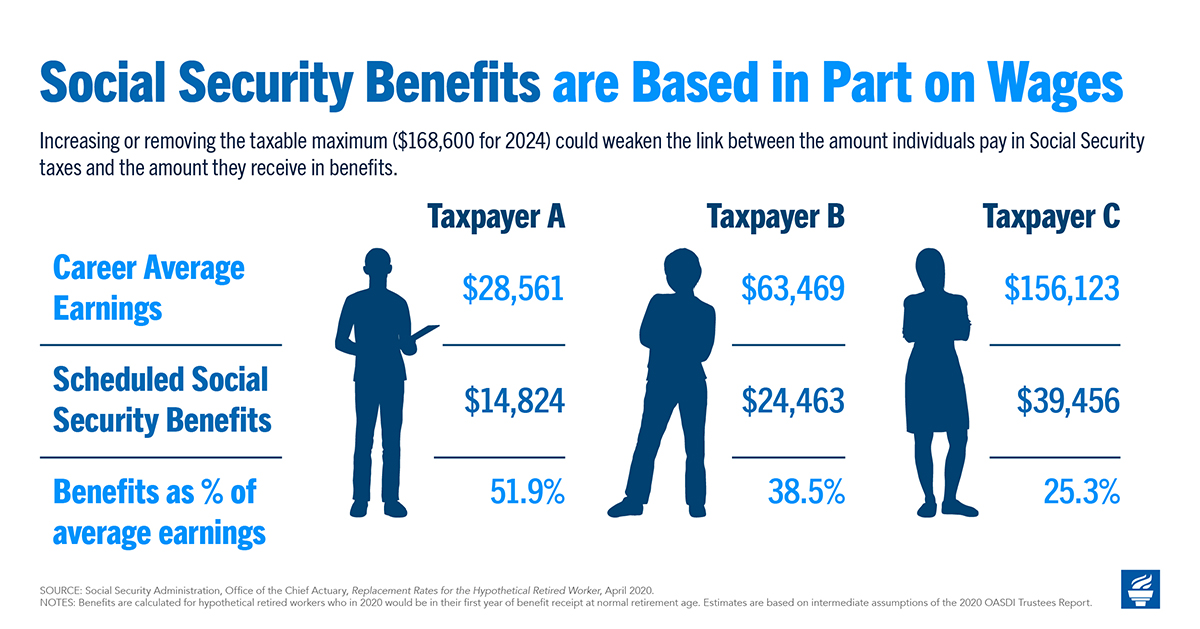

Tax Relief For 2024 Social Security Should We Eliminate the Social Security Tax Cap? Here Are the Pros : Roughly one in seven retirees in the U.S. rely on Social Security for nearly all their income, according to an AARP analysis. But these benefits don’t always come without Uncle Sam’s strings . or $85,000 as a single filer, you’ll have to pay some tax on your benefits unless the amount your AGI exceeds the threshold is less than your Social Security benefit amount. Beginning in tax year 2024 .